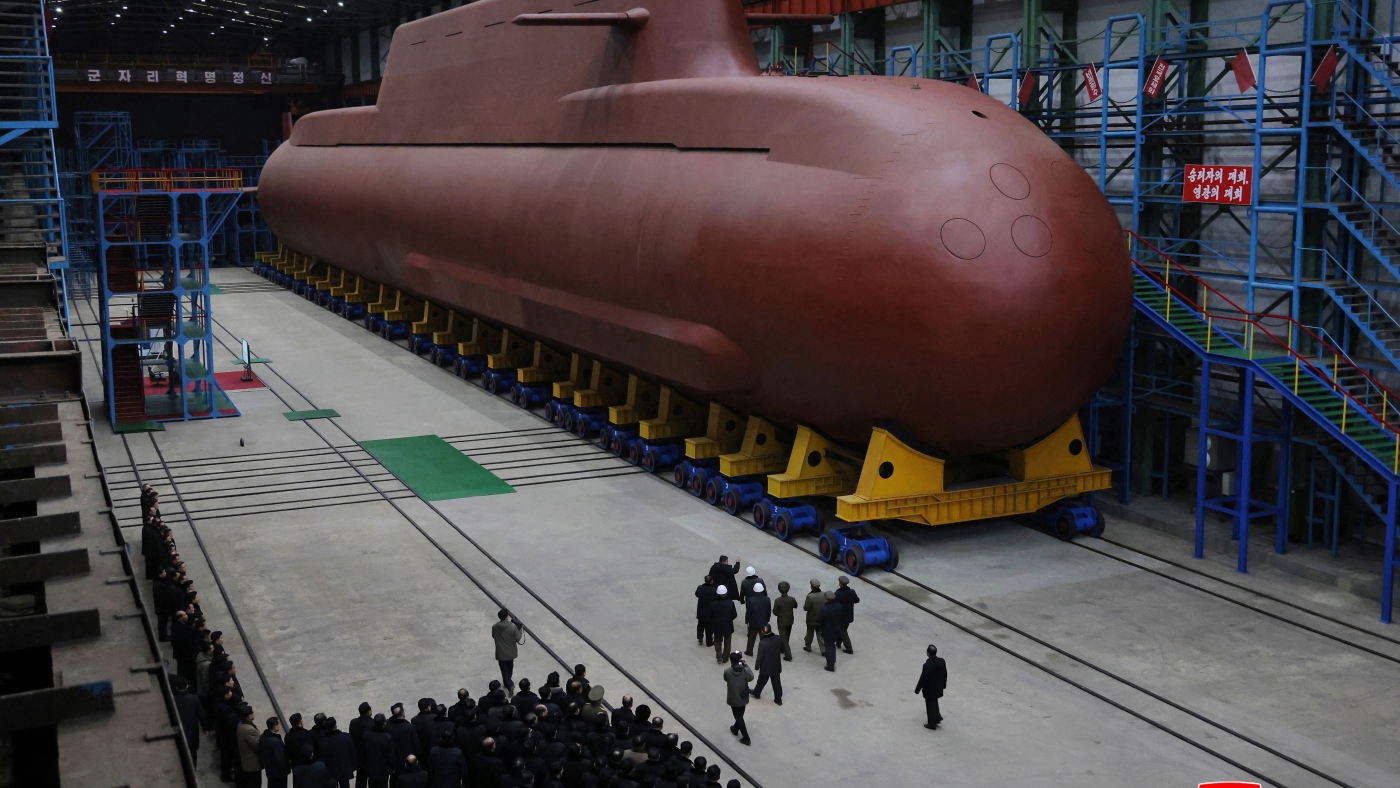

The U.S. Navy is pioneering the use of collaborative robots, or cobots, to enhance the efficiency of submarine maintenance. This initiative, led by Fairbanks Morse Defense, aims to extend the operational life of aging engines in both Los Angeles-class and Ohio-class submarines. In a recent interview with Defense One, Steve Pykett, CEO of Fairbanks Morse Defense, explained how these advanced machines are transforming traditional maintenance methods.

Typically, skilled welders have been tasked with repairing engine components within challenging confines. Welders would often work in cramped and hazardous conditions, accessing the engine through a small opening. Pykett noted that this process involved making hundreds of weld beads to address wear locations, presenting significant safety and comfort concerns for workers. The introduction of cobots, which utilize machine learning to automate welding tasks, promises to not only improve safety but also drastically reduce the time required for maintenance.

“What was five weeks is now five days,” Pykett stated, emphasizing the efficiency gained through this technology. The cobots operate under the supervision of a trained operator, who remains in a safer environment while monitoring the process. This shift not only expedites repairs but also aligns with the Navy’s goal of maintaining rigorous shipbuilding and maintenance schedules.

Expanding the Role of Automation in Defense

Fairbanks Morse Defense is already utilizing automation for machining original equipment, such as forgings, but is looking to broaden the application of this technology across other naval vessels. Pykett mentioned plans to adapt the cobots for use in more confined spaces within submarines and surface vessels, potentially allowing the machines to navigate complex geometries autonomously.

The advancements in automation are timely, as defense contractors report a mixed bag of financial performances. During recent earnings calls, three major players—Boeing, Northrop Grumman, and RTX—discussed their financial results and future strategies.

Boeing faced a challenging close to 2025, reporting a loss of $565 million on the Air Force’s KC-46 tanker program. CEO Kelly Ortburg acknowledged the difficulties but highlighted “encouraging operational performance trends” that could help the company meet delivery commitments in the future.

In contrast, Northrop Grumman CEO Kathy Warden focused on the company’s investments in unmanned systems and munitions production. She detailed plans to triple the production of tactical solid rocket motors by 2030, while addressing concerns over a recent billion-dollar deal between the Pentagon and L3Harris.

Meanwhile, RTX CEO Christopher Calio responded to criticisms from the White House regarding munitions production. He acknowledged the urgency to ramp up production and pledged to significantly increase output in the coming year. “Output was up over 20 percent on a number of critical programs,” he stated, assuring stakeholders that their focus remains aligned with the government’s requirements.

Investments in Defense Technology

In an effort to bolster innovation, Booz Allen Hamilton announced plans to invest $400 million in the venture capital firm Andreessen Horowitz. This partnership seeks to enhance the scaling of defense technology companies by leveraging Booz Allen’s extensive portfolio and insights. Steve Escaravage, head of Booz Allen’s defense technology business, remarked on the collaboration’s potential to bridge operational gaps that hinder scaled adoption of new technologies.

In addition to these developments, Leonardo DRS has opened a new propulsion manufacturing plant to support Navy submarine and shipbuilding programs. Simultaneously, Hadrian, a startup specializing in AI-driven manufacturing, is launching a new factory in Mesa, Arizona, aimed at modernizing production processes within the defense and aerospace sectors.

As the defense industry continues to evolve, the integration of advanced technologies like cobots and strategic partnerships appear crucial for enhancing operational efficiency and maintaining the readiness of military assets. The concerted efforts of companies such as Fairbanks Morse Defense, Boeing, Northrop Grumman, RTX, and Booz Allen Hamilton reflect a broader trend towards innovation in defense manufacturing and maintenance.