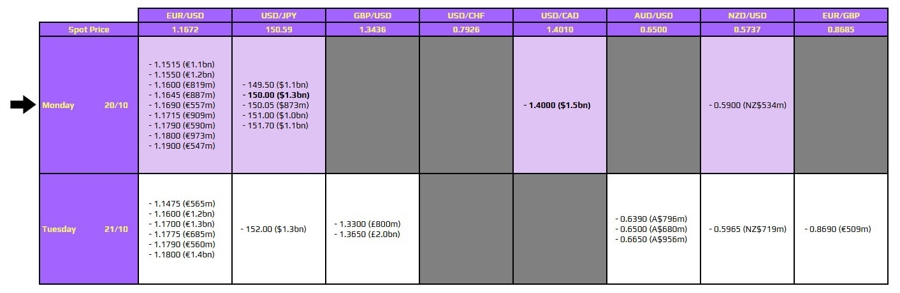

URGENT UPDATE: Significant FX options expirations are set for 10 AM New York time today, impacting key currency pairs including USD/JPY and USD/CAD. Traders are closely monitoring these developments as they unfold.

The USD/JPY is approaching the critical 150.00 mark, having recently broken below this level. Political shifts in Japan are heightening market volatility, with the ruling LDP and Nippon Ishin expected to form a coalition, likely positioning Takaichi as the new Prime Minister. While this political stabilization is generally positive for the yen, Takaichi’s reputation as a fiscal dove raises concerns.

As these FX options expire, they may limit downward movement in the USD/JPY during today’s session. Analysts anticipate resistance forming closer to 151.00, where the 100-hour moving average resides. A modest set of expiries in this range could further restrict price movements.

Meanwhile, the USD/CAD is seeing expiries at the 1.4000 level. Although this threshold lacks technical significance, it could serve as a barrier against further declines for the pair, which has been drifting lower since late last week.

Traders are advised to stay vigilant as these developments could lead to rapid changes in market dynamics throughout the day. For further insights and analysis on how to navigate these expiries, visit investingLive (formerly ForexLive).

Stay tuned for more updates as we track the impact of these expirations and political changes on the forex market. The situation is evolving rapidly—be ready to act!