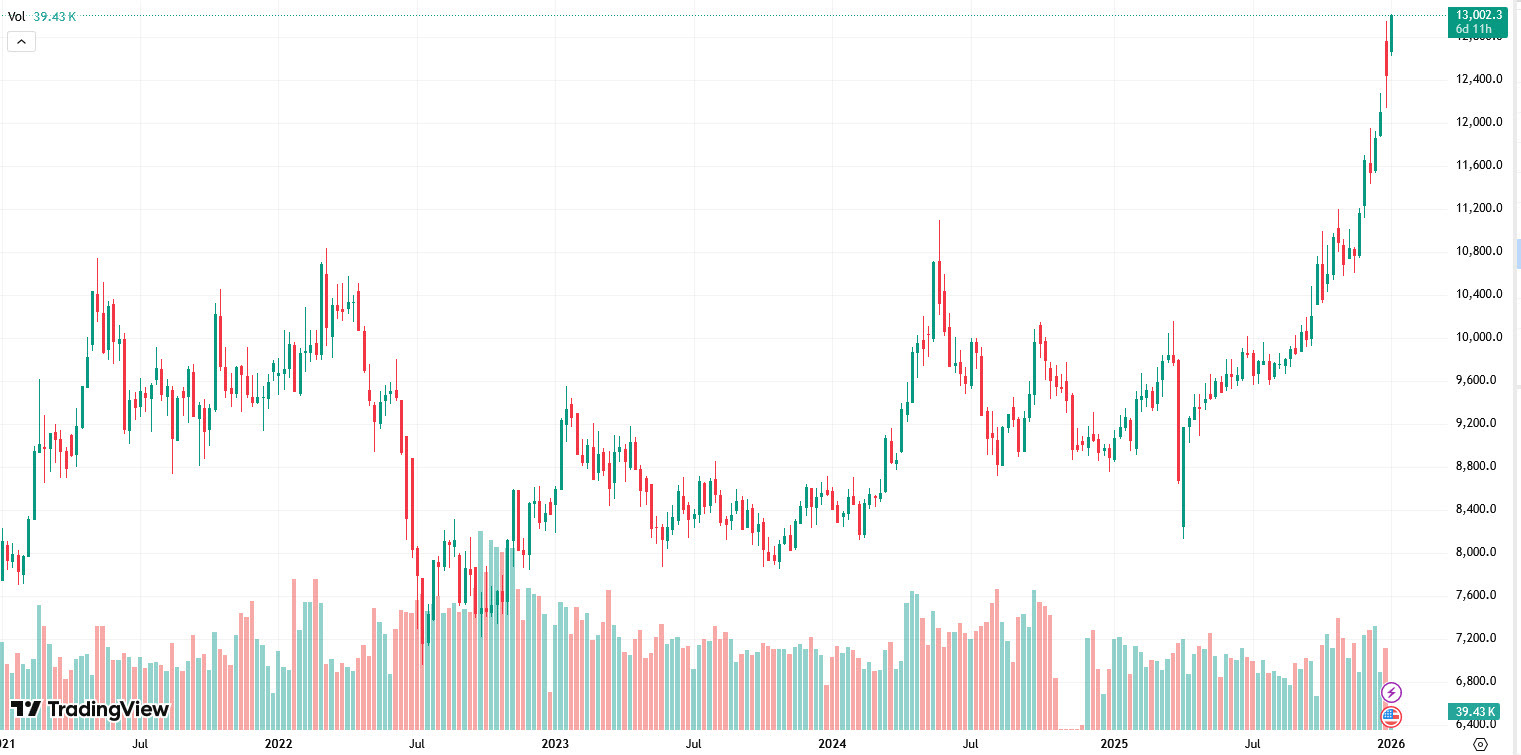

UPDATE: Copper prices have skyrocketed to a historic high of $13,000 per ton in London, driven by significant supply disruptions. This surge comes as a strike at Capstone Copper’s Mantoverde mine in Chile has left operations at merely 30% capacity, raising urgent concerns about global copper availability.

The strike, which has impacted approximately half of the Mantoverde workforce, was initiated after mediation efforts failed. As the situation unfolds, analysts predict that this could exacerbate the already tight copper market, which has been under pressure due to ongoing challenges at the Grasberg mine, primarily affected by last year’s catastrophic mudslide.

Currently, production estimates for Mantoverde during this strike period range from 29,000 to 32,000 tons, a drop that, while smaller than the 270,000 tons expected to be offline at Grasberg for the entire year, still represents a crucial loss in a market already sensitive to supply shocks. The Grasberg mine is projected to gradually resume operations starting in Q2 2024, but until then, any disruptions could significantly impact global supply.

The Mantoverde strike is taking place in the Atacama region, adjacent to the Antofagasta region, a heavyweight in copper production known for hosting some of the largest copper mines in the world. The labor unrest reflects broader dissatisfaction that could lead to more strikes, especially as five separate union contracts at Chile’s state-run Codelco are set to expire this year. Negotiations are already contentious, focusing not just on wages but also on safety and production rates.

With the market already on edge following substantial outages in Indonesia, every additional ton lost amplifies the bullish momentum. The technical landscape appears favorable for further price increases, with projections indicating that prices could soar upwards of $16,000 by 2025.

As the situation develops, stakeholders are watching closely. The potential for further labor disputes could signal a significant shift in the copper industry, impacting not only prices but also the broader economy. For investors and consumers alike, the stakes are high as copper remains a critical component in various industries, including renewable energy and electric vehicles.

Stay tuned for more updates as this urgent situation continues to unfold.