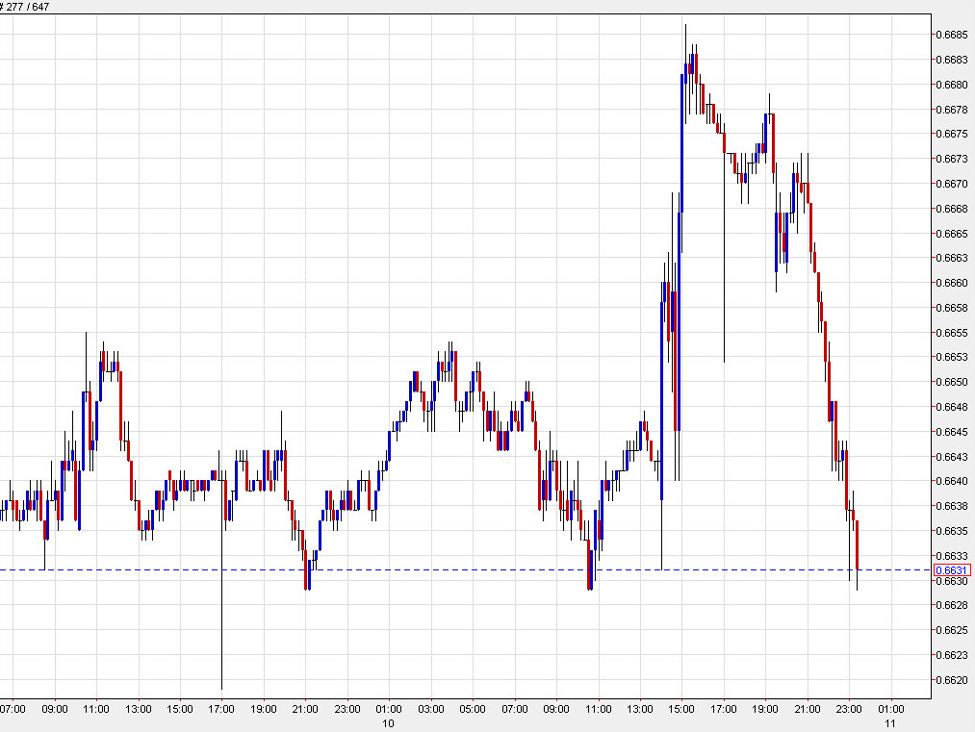

URGENT UPDATE: The Australian dollar (AUD) is experiencing a sharp decline in Asia this morning, reversing gains made following the U.S. Federal Reserve’s latest policy announcement. As of October 12, 2023, AUD/USD is unwinding its post-Fed rally, coinciding with a broader downturn in global stocks.

Trading in Asia initially aimed to extend the AUD’s upward momentum, but quickly lost steam, leading to significant profit-taking. The decline was exacerbated by disappointing earnings reports from tech giant Oracle, which sent their shares tumbling and reignited concerns over excessive spending in the artificial intelligence sector.

In a silver lining for the Australian economy, the Fed has boosted its GDP growth forecast for 2026 to 2.3%, a notable increase from the previous estimate of 1.8%. This upward revision signals potential strength in global growth and could benefit Australian commodity exports, a crucial component of the nation’s economy.

However, the outlook for the Australian dollar remains clouded. Recent struggles in Chinese stocks have undermined investor confidence, raising doubts about Australia’s growth trajectory. Analysts are now suggesting that a more substantial catalyst is needed to invigorate the market.

Economist Adam Button from Investinglive.com noted, “We might have to wait for something more significant than the Fed to jolt the market, but we might have to wait until 2026 to see it.” This commentary highlights the uncertainty surrounding the AUD’s near-term prospects and the broader economic environment.

As trading continues, market watchers will be closely monitoring developments in both the U.S. and Asia. The interdependencies of global markets mean that shifts in one region can have immediate repercussions elsewhere, particularly for currencies like the AUD that are heavily influenced by commodity prices and international trade.

Stay tuned for more updates as this situation develops.