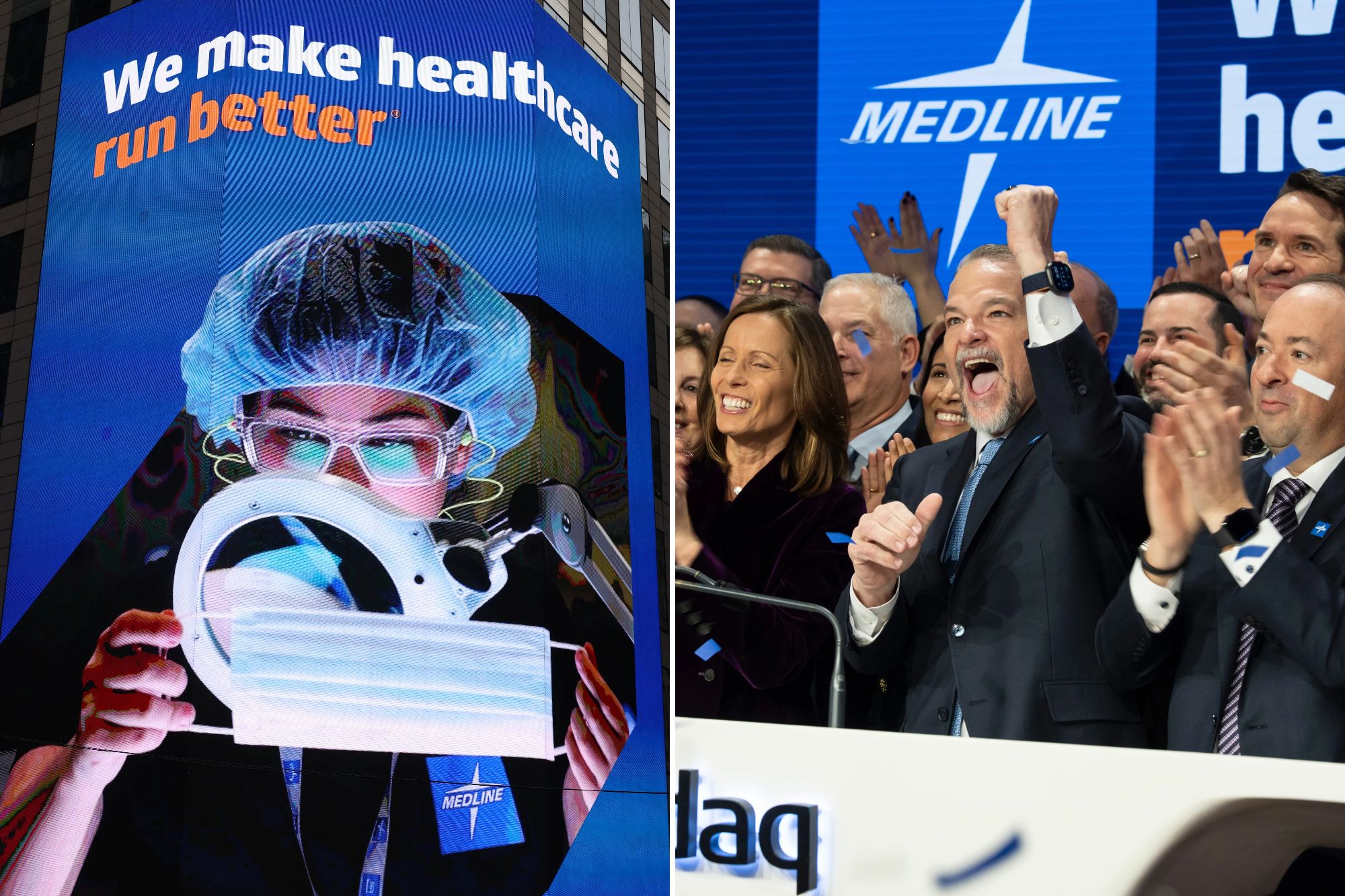

Medline Industries, a major player in the medical supply industry, saw its shares surge over 30% during its initial public offering (IPO) on September 27, 2025. This surge valued the company at approximately $46 billion, marking it as the largest IPO in the United States since Rivian’s debut in 2021. The company’s shares opened at $35, significantly higher than the IPO price of $29 per share.

Founded in 1966, Medline is headquartered in Northfield, Illinois. The company specializes in manufacturing and distributing essential medical supplies, including surgical kits, gloves, and gowns utilized in hospitals around the world. Medline’s IPO raised $6.26 billion through the sale of 216 million shares, making it the largest private-equity-backed IPO in history. The firm was acquired in 2021 for $34 billion by a consortium of investors including Blackstone, Carlyle, and Hellman & Friedman.

Strong Financial Performance Fuels Investor Interest

Medline’s CEO, Jim Boyle, expressed confidence in the company’s future, stating, “We’re going to run the business exactly the same way we ran it yesterday. It (the IPO) just allows us to buy down debt and amplify our voice.” The company’s robust financial performance has attracted investors, as it has consistently reported net sales growth across economic cycles and the COVID-19 pandemic.

For the nine months ending September 27, 2025, Medline reported a net income of $977 million on revenues of $20.6 billion, an increase from $911 million on $18.7 billion during the same period the previous year. Medline’s strong growth trajectory and profitability differentiate it from many other growth-focused IPOs.

Despite challenges such as tariffs affecting supply chains, Medline has maintained a strategic advantage with its diverse manufacturing footprint. Boyle noted that approximately half of the company’s production occurs within the United States or North America, which helps mitigate the impact of tariffs from sourcing in regions like Asia.

Market Outlook and Future Prospects

The IPO climate in the United States has remained resilient in 2025, with first-time share sales raising a total of $46.15 billion—the highest since the 2021 boom—excluding blank-check companies. The total number of traditional offerings has increased by over 21% compared to the previous year.

According to Nicholas Einhorn, director of research at Renaissance Capital, “The IPO market continued its recovery in 2025 despite the headwinds of tariffs and a government shutdown, which prevented what could have been a more significant rebound.”

Other notable IPOs this year have included companies such as liquefied natural gas producer Venture Global, Swedish fintech Klarna, cloud-computing firm CoreWeave, and stablecoin issuer Circle. Wall Street analysts anticipate a strong pickup in IPO activity for 2026, with high-profile firms like Elon Musk’s SpaceX considering a potential market flotation.

The successful listing of Medline may also encourage additional private equity-backed firms to pursue their IPO plans. Leading financial institutions including Goldman Sachs, Morgan Stanley, BofA Securities, and JPMorgan served as lead bookrunning managers for Medline’s offering, underscoring the significant interest surrounding this high-profile transaction.