Retailers across the United States are facing significant challenges due to a shortage of pennies, leading to financial losses and operational adjustments. The U.S. Mint’s decision to halt production of the one-cent coin has left many businesses scrambling to provide change for cash transactions. As a result, retailers are either undercharging customers or absorbing losses.

According to Dylan Jeon, the senior director of government relations with the National Retail Federation, “You’re talking about losing up to four cents for every cash transaction across multiple stores across the country. It’s unsustainable.” This statement highlights the financial strain that the penny shortage is placing on retailers nationwide.

The situation is a direct outcome of former President Donald Trump’s announcement in February 2023, when he revealed the cessation of penny production due to rising costs. The production of pennies had become economically unviable, with each coin costing nearly four cents to manufacture. The final order for penny blanks was placed by the U.S. Mint in May, with the last coins rolling off the production line in August 2023.

As the impact of this decision ripples through the economy, retailers are adapting. A statement from McDonald’s USA acknowledged the issue, noting, “Following the discontinuation of pennies nationwide, some McDonald’s locations may not be able to provide exact change.” The fast-food giant emphasized that it is working on long-term solutions to ensure fairness for customers.

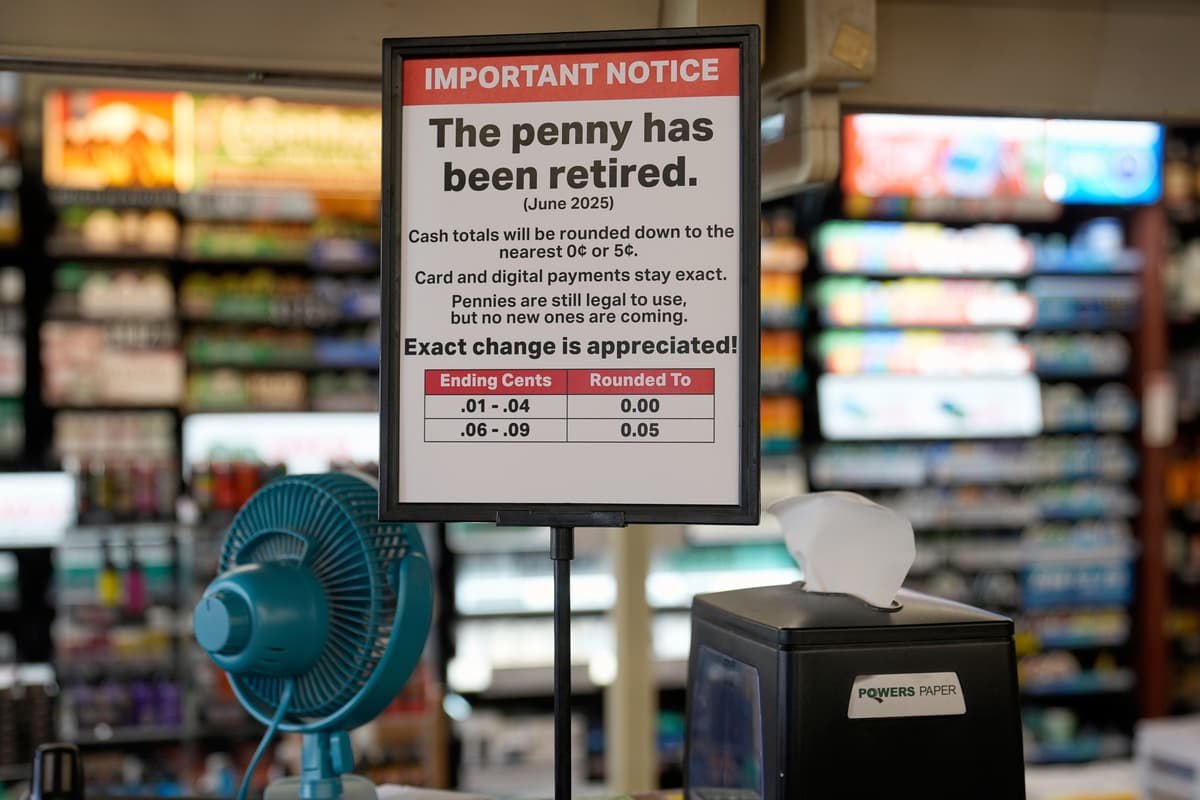

In response to the shortage, retailers are employing various strategies to mitigate losses. For example, Giant Eagle, a grocery chain based in Pennsylvania, is launching a one-day event where customers can receive two cents on a gift card for every penny they turn in. Similarly, Sheetz Convenience Stores is enticing customers by offering a free soda for purchases made with a dollar’s worth of pennies. Other businesses have begun encouraging the use of credit or debit cards, while some are rounding cash transactions to the nearest nickel.

Banks are also feeling the pressure, with many rationing their limited supplies of pennies and reserving them for high-volume customers. This shortage has raised concerns about the broader implications for cash transactions in the retail sector.

Despite the current difficulties, the experiences of other countries that have eliminated their one-cent coins provide a glimpse of potential adaptation. Canada, Australia, Ireland, and New Zealand have all successfully moved away from the penny without major disruptions. In Canada, the last penny was minted in 2012, and while there was initial confusion at cash registers, most Canadians adapted quickly. Cash transactions are now rounded to the nearest nickel, while electronic transactions remain precise.

Reflecting on this adaptation, a blog from colonialacres.com notes that over a decade later, “Most people have forgotten that the Canadian penny ever existed.” This suggests that the U.S. may also find ways to navigate the penny shortage without severe economic consequences.

As retailers continue to grapple with this coin shortage, the focus remains on balancing customer satisfaction with operational viability. The situation underscores a growing trend in the economy, where cash transactions are declining, and digital payment methods are becoming increasingly prevalent. The outcome of this adjustment period will likely shape the future of cash transactions in the U.S. retail landscape.