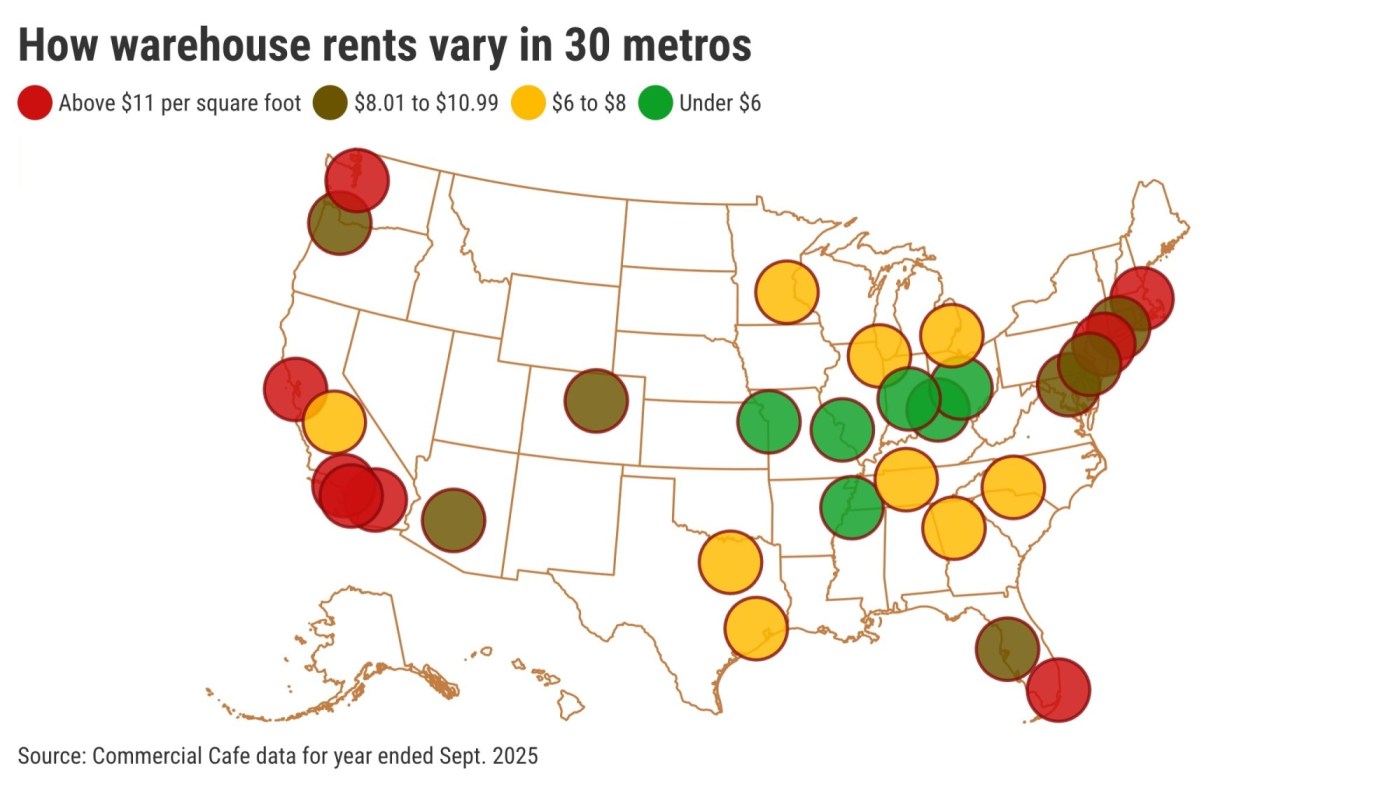

URGENT UPDATE: Southern California has officially claimed the title for the highest industrial rents in the nation, as revealed in a new report by Commercial Cafe. With Orange County leading at an eye-watering average of $17.09 per square foot, the region’s warehouse and logistics market is showing no signs of slowing down.

Latest data shows that Orange County’s industrial lease rates have surged 7% over the past year, with new leases climbing even higher to $19 per square foot. Meanwhile, the Los Angeles market follows closely behind, with rents averaging $15.59 per square foot, marking a 5% increase. New leases in L.A. are at $14.88, ranking 6th nationally.

This dramatic rise in rent costs has significant implications for the region. The high demand for warehouse space is largely driven by the logistical needs of one of the world’s largest shipping hubs located at the Los Angeles/Long Beach ports. As the second-most populous area in the nation, Southern California requires extensive logistics networks to support its economy.

In stark contrast to the national average of $8.72 per square foot, which has increased 6% in the past year, the Inland Empire offers a relatively lower rate of $11.65, ranking 7th in the country. New leases in this area average $14.58, still among the highest.

Despite these costs, vacancy rates in Southern California remain notably low, making it difficult to find available warehouse space. The Inland Empire has a vacancy rate of just 7.7%, the 8th lowest among major markets. Orange County reports 8.2% and Los Angeles 8.3%, both well below the national vacancy rate of 9.5%.

As a result of these factors, selling prices for industrial properties in the area are soaring. In the first nine months of 2025, Orange County industrial properties sold for an average of $306 per square foot, the second-highest in the nation after Detroit. This valuation is more than double the average national price of $142 per square foot. Similarly, Los Angeles warehouses fetched $282 per square foot, ranking 3rd, while the Inland Empire reported prices of $234, placing it 6th.

These soaring costs and limited availability highlight the urgent need for businesses to navigate this competitive market effectively. As demands continue to rise, stakeholders must stay alert to emerging trends and shifts in the commercial real estate landscape.

Keep watching for further updates as this story develops, and what it means for both businesses and consumers alike in the Southern California region.