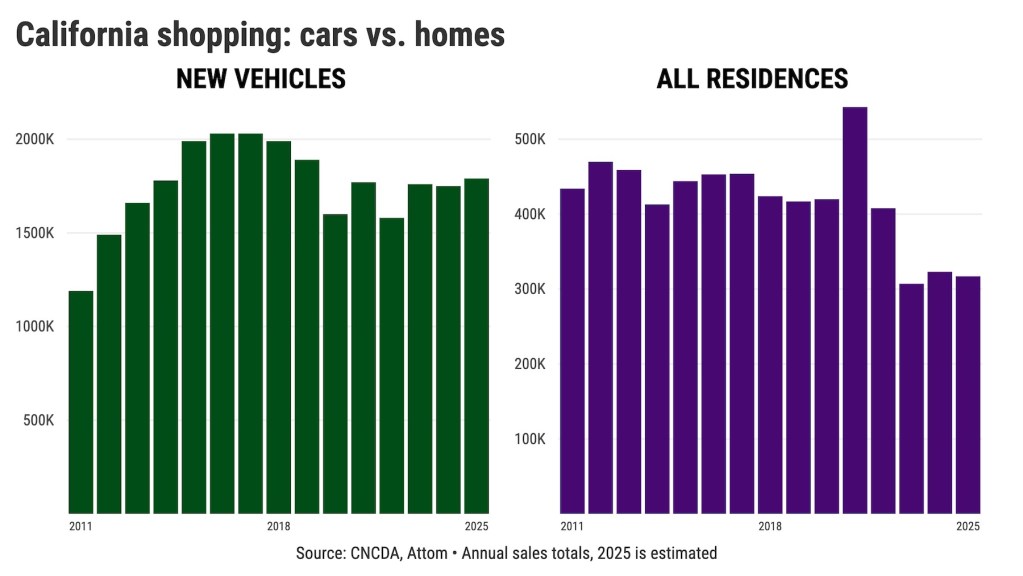

UPDATE: Californians are pulling back on major purchases, with both home and vehicle sales showing significant declines as economic uncertainty grips the state. Latest reports indicate that 317,000 residences are projected to be sold in 2025, a 2% drop from 2024. Meanwhile, vehicle sales are expected to reach 1.79 million, marking only a minimal increase of 2% from the previous year.

Consumer confidence in California is wavering, as residents hesitate to make substantial investments amid a shaky economy. The California New Car Dealer Association reports that car sales are still struggling to recover from the pandemic’s disruptions, trailing 12% behind the pre-pandemic peak of 2.03 million sales in 2016 and 2017.

The situation is equally grim for homebuyers. Sales figures are 42% below the 543,000 homes sold at the height of the market in 2021, when favorable mortgage rates fueled a buying frenzy. As interest rates climb, affordability becomes a growing concern: the average price of a new car surpassed $50,000, while a 30-year mortgage now sits at 6.8%, a sharp increase from 2.9% in 2020.

John Sackrison, executive director of the Orange County Auto Dealers Association, attributes the sluggish sales to lingering supply chain issues and economic anxieties heightened by recent political changes. “Uncertainty tends to make consumers pull back,” Sackrison states, emphasizing the impact of rising prices and interest rates on buyer sentiment.

As manufacturers respond to this slow market, various incentives are being offered to entice consumers back into showrooms. Yet, many Californians remain hesitant to commit to purchases that require significant financial investment.

This trend isn’t limited to California. Nationally, vehicle sales are projected to run at a pace of 16.3 million annually in 2025, down 3% from last year. Home buying is similarly subdued, with nationwide purchases down 2%, reflecting the overall struggle in consumer spending.

As the economic landscape continues to evolve, Californians are urged to stay informed about these developments. The implications of these purchasing trends will be felt across various sectors, impacting job markets and economic growth in the long run.

What happens next? Analysts will be closely monitoring how shifting economic conditions, inflation, and interest rates influence consumer behavior in the coming months. The urgency to adjust strategies in both the automotive and real estate markets is palpable as buyers reconsider their options amidst financial pressures.

Stay tuned for further updates on this developing story as California navigates these challenging economic waters.