The European Union’s regulatory framework is significantly hindering its competitive edge in the artificial intelligence (AI) sector, allowing the United States to maintain a dominant position in the global market. With over 50 percent of the world’s AI unicorns based in the U.S., Europe finds itself sidelined in a race that appears increasingly one-sided. This situation resembles the dynamics of the dot-com boom 25 years ago, with massive capital flowing into AI technologies and data center infrastructure.

The number of AI unicorns provides a stark illustration of the EU’s lagging innovation capacity. Currently, approximately 1,700 AI startups valued at over $1 billion operate in the U.S., while Europe hosts around only 280. This discrepancy highlights a significant economic gap: the U.S. commands more than 50 percent of the global AI market, whereas Europe accounts for less than ten percent. Investment trends further reinforce this divide. Hyperscale tech companies such as Amazon, Microsoft, Alphabet, and Meta collectively invested over $320 billion in AI technologies this year. In contrast, European investments in similar sectors reached just under €100 billion, with data center capacity in the U.S. growing by around 160 percent compared to only 75 percent in Europe.

Investment and Innovation Disparities

The expansion of nuclear power as an energy source in various regions adds another layer to the conversation. While Germany has resisted nuclear energy for ideological reasons, the increasing energy demands of new technologies may prompt a reevaluation of this stance. Notable projects in Europe, such as the Brookfield project in Sweden and the Start Campus in Portugal, each boast investment volumes of nearly $10 billion.

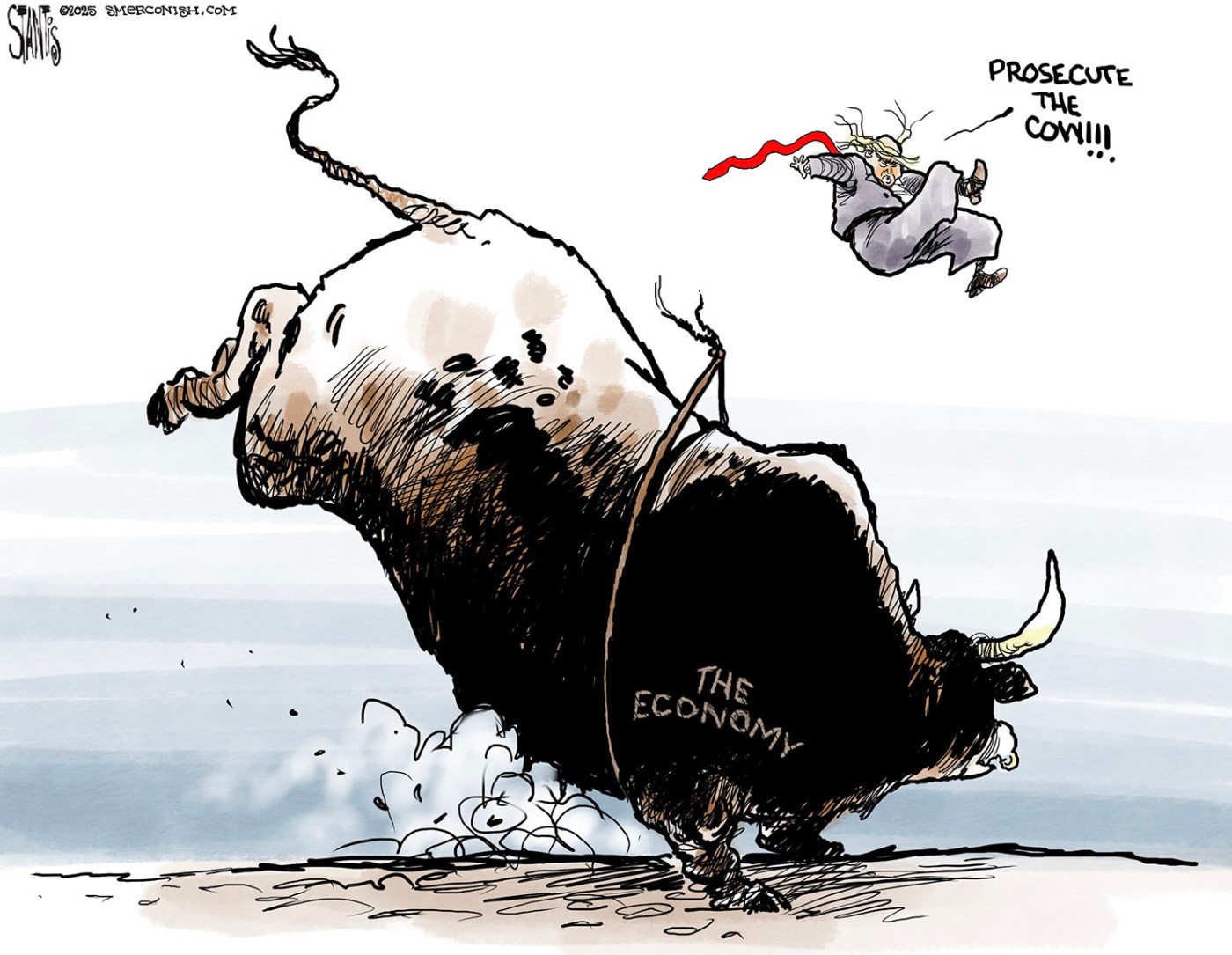

The ideological clash between the U.S. and the EU becomes particularly evident in the realm of AI. The U.S. approach favors deregulation and private enterprise, fostering competition and innovation. By contrast, the EU continues to emphasize political oversight and centralized planning, with Brussels officials playing a significant role in shaping technological advancements. The EU’s Invest-AI plan, spearheaded by Ursula von der Leyen, aims to borrow around €50 billion for targeted projects over several years, with the expectation of triggering private investments of €150 billion. Critics argue this reliance on public financing and central planning reflects a misguided understanding of how innovation truly flourishes.

The impact of stringent regulations is tangible. The European Commission has imposed over €3.2 billion in fines this year, predominantly targeting U.S. corporations. This regulatory environment fosters a predatory atmosphere that discourages startups and pushes private industry to seek more favorable conditions elsewhere. The EU’s approach, characterized by a complex web of funding programs and subsidies, often stifles entrepreneurs instead of empowering them.

Future Prospects and Economic Paradigms

As Europe grapples with these challenges, the lessons from history remain pertinent. The economist Ludwig von Mises emphasized that it is the entrepreneur who drives market economies through profit-seeking initiatives. He argued that decentralized processes create prosperity, while state interventions often derail economic growth. The current EU framework appears to contradict these principles, fostering corporatist structures that hinder competition.

The ongoing shift towards AI and other groundbreaking technologies is likely to trigger an investment boom, reminiscent of past economic cycles. While the initial phases may lead to overinvestment and subsequent market corrections, the long-term impact will cement economically viable structures within the existing economy. European stakeholders may soon look back on this period and reflect on the contrasting paths taken by regions like the U.S. in comparison to their own.

Ultimately, the energy needed to support these innovations will come from a mix of sources, including nuclear power from French and Polish facilities. As the EU continues to navigate the complexities of its regulatory landscape, the question remains whether it can adapt to foster a more competitive environment that supports innovation and growth in the AI sector. The stakes are high, and the implications of these decisions will resonate across the global economy for years to come.