URGENT UPDATE: New data reveals that China’s global lending portfolio has surged to an astounding $2.1 trillion, according to a recent report by Virginia-based research institute AidData. This staggering figure marks a significant shift in global finance dynamics, positioning China as the world’s largest creditor and reshaping international relations.

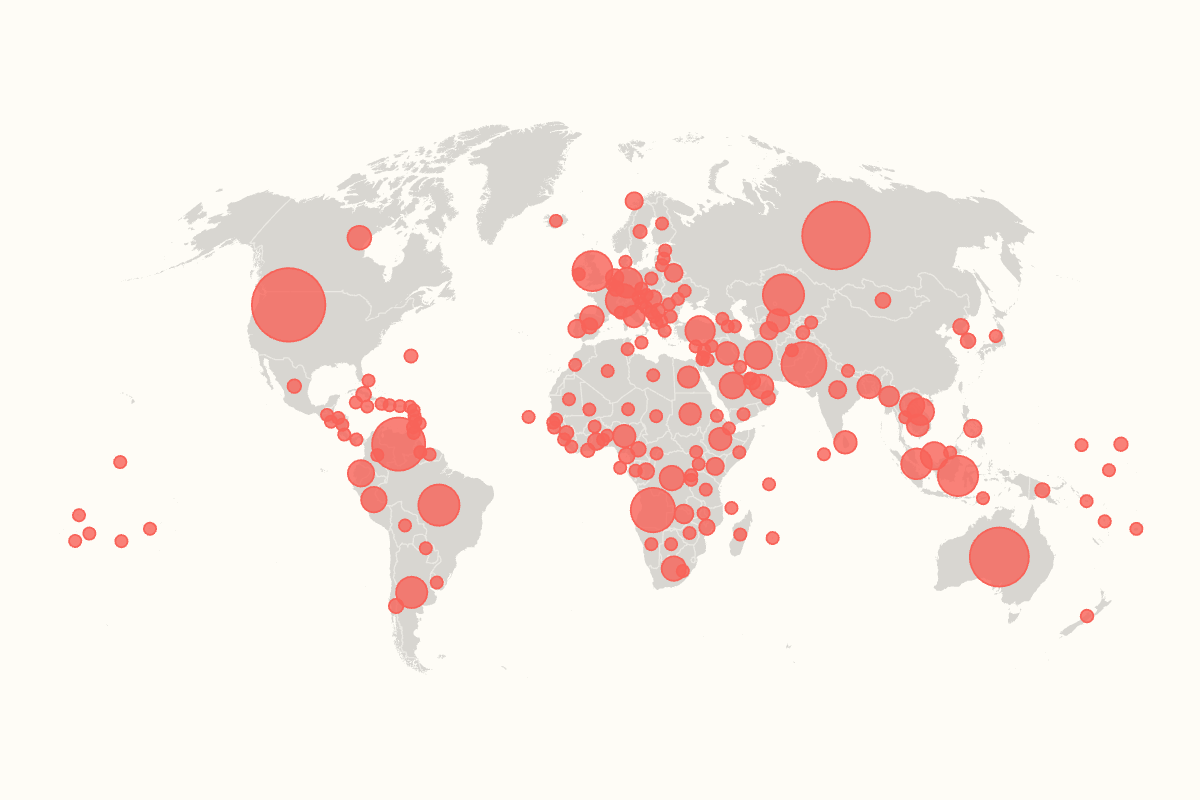

The report, which analyzed 30,000 projects across 217 countries, shows that China’s lending is not solely focused on developing nations as previously assumed. Instead, 76 percent of these loans were issued to high- and upper-middle-income countries, including major economies such as the United States and Australia.

Among the top 10 recipients, the United States topped the list with a remarkable $202 billion in loans linked to over 2,500 projects. Following closely, Russia, China’s “no-limits” strategic partner, received $172 billion, while Australia ranked third with $130 billion. Other significant recipients include Venezuela and Pakistan, with loans totaling $105.7 billion and $75.6 billion, respectively. The United Kingdom, the sixth-largest economy, ranked tenth.

This report comes amid ongoing debates surrounding China’s lending practices, often criticized as “debt-trap diplomacy.” Critics argue that high repayment demands can lead to financial distress for borrowing nations. However, Chinese officials contest this narrative, asserting that their overseas lending is rooted in mutually beneficial, market-driven principles.

“China’s financing focuses on infrastructure and capacity-building to enable self-reliance, not create dependency,” stated Yang Baorong, director of African Studies at the Chinese Academy of Social Sciences, in a recent interview with state-run newspaper the Global Times.

The AidData report challenges long-held assumptions about China’s role in global finance, as it compiled its findings from various sources, including loan contracts and host-country documentation, due to China’s lack of transparency in foreign lending. This unprecedented analysis positions China as a “new global pace-setter rewriting the rules” for international aid and credit.

WHAT’S NEXT: The implications of this report extend beyond financial metrics. Major lenders, including the U.S., Germany, and Japan, are now compelled to reassess their credit and aid strategies to remain competitive against China’s expanding influence.

As global dynamics continue to evolve, the spotlight remains on how this surge in Chinese lending will affect international relations and economic stability going forward. Keep an eye on these developments, as they could reshape the landscape of global finance for years to come.