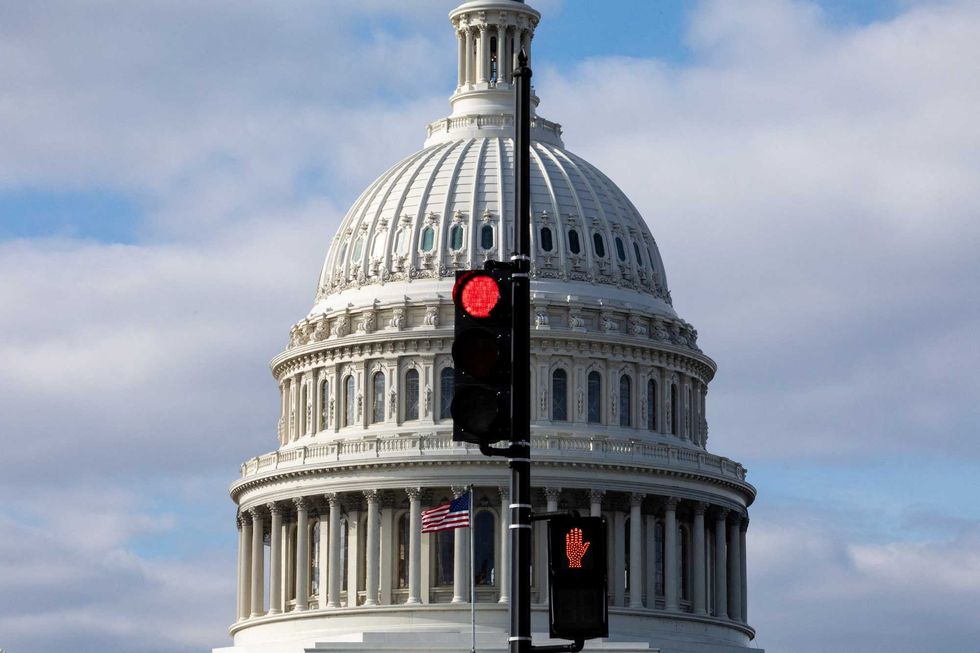

As the deadline of December 15, 2025 passed without an agreement on federal subsidies, millions of Americans are likely to face significant increases in health care costs starting in 2026. The Affordable Care Act (ACA) subsidies, which have made health insurance more affordable for many, are set to revert to their previous, less favorable levels. This development comes after a last-minute effort in the House to extend these subsidies failed, leaving Congress to adjourn for the year on December 19.

Disagreement over health care funding in the U.S. has persisted for decades, particularly surrounding the question of whether it is the government’s responsibility or that of individuals and employers to provide health coverage. The ACA, enacted in 2010, was a pivotal moment in this ongoing debate, aiming to reduce the number of uninsured Americans by approximately 30 million. Despite its ambitions, the number of uninsured individuals remains around 26 million, or 8 percent of the population, as of late 2025.

Understanding the ACA and Its Impact

Before the ACA was implemented, around 49 million Americans lacked health insurance, a figure that rose sharply following the economic downturn in 2008. The ACA introduced multiple strategies to combat this issue, including the expansion of Medicaid and the introduction of subsidies for low- and moderate-income individuals to purchase insurance through the ACA marketplace. While some provisions, like allowing young adults to stay on their parents’ insurance until age 26, were well-received, others, such as the individual mandate to obtain insurance, sparked controversy.

The ACA’s expansion of Medicaid was particularly contentious. Initially mandated for all states, the Supreme Court ruled that participation was up to each state, resulting in 40 states and the District of Columbia opting to adopt it by late 2025. This expansion has provided coverage for approximately 20 million Americans. The subsidies for marketplace insurance were less controversial at first, but the recent pandemic-era enhancements have dramatically changed the landscape.

Impending Cost Increases for Consumers

As the temporary COVID-19-era subsidies are set to expire at the end of 2025, many consumers will see their health care costs rise sharply. For instance, an individual earning $45,000 annually may see their monthly insurance premium increase by 74 percent, amounting to an additional $153 each month. Furthermore, insurance plan prices are projected to rise by another 18 percent in 2026, meaning many ACA marketplace users could grapple with over a 100 percent increase in costs.

Proponents of extending the enhanced subsidies warn that without intervention, between 6 million and 7 million people may exit the ACA marketplace, with an estimated 5 million potentially becoming uninsured in 2026. The situation is exacerbated by recent policy changes, including cuts to Medicaid as stipulated in a tax and spending package signed into law by former President Donald Trump in July 2025. The Congressional Budget Office predicts these cuts could lead to over 7 million more individuals losing insurance.

The interplay of these factors could result in a staggering 16 million people becoming uninsured by 2034, effectively undoing much of the progress made since the ACA’s inception.

Critics of the extended subsidies argue that the financial burden on the federal government has increased significantly, with nearly 22 million individuals receiving assistance in 2025, a major jump from 9.2 million in 2020. Opponents assert that these funds are supporting higher earners who do not require assistance and that temporary emergencies should not lead to lasting policy changes.

Additionally, there are concerns that the ACA has allowed employers to reduce their insurance responsibilities. A stark decline in health insurance offerings by employers with 25 to 49 employees—from 92 percent in 2010 to 64 percent in 2025—suggests that many are relying on the ACA to cover their workforce.

Future of Healthcare Coverage in the U.S.

The U.S. healthcare system is the most expensive in the world, and the potential increase in the uninsured population over the next decade could incur even higher costs down the line. A decrease in insured individuals typically leads to reduced preventive care and delayed treatment, resulting in more complex healthcare needs.

While federal policies significantly affect health insurance coverage, state-level decisions also play a crucial role. Nationally, about 8 percent of individuals under age 65 were uninsured in 2023, with disparities ranging from 3 percent in Massachusetts to 18.6 percent in Texas. These variations reflect the broader political divides influencing the national conversation regarding healthcare responsibility.

With differing ideologies at play, the solutions proposed reflect these divisions. Advocates for government responsibility suggest expanding coverage and financing through taxes, while those favoring individual responsibility argue for a market-driven approach to healthcare costs. Until a consensus is reached on this fundamental issue, the debate surrounding healthcare in the U.S. is likely to persist for years to come.