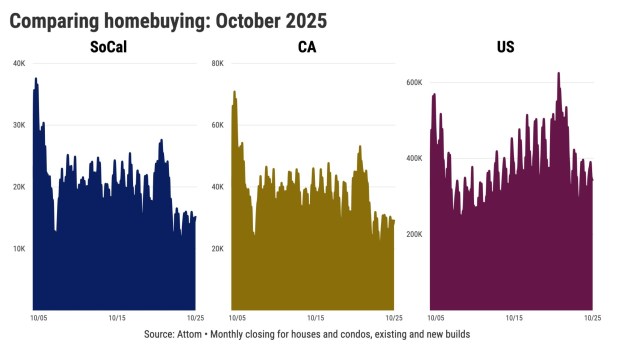

URGENT UPDATE: California’s housing market faces a significant downturn, with home sales plummeting to their lowest levels in over two decades. In October, there were just 29,379 closed sales of houses and condos across the state, marking a staggering 22% drop below the October average since 2005, according to real estate tracker Attom.

This sharp decline makes it the fourth-slowest October for homebuying in 21 years, raising concerns about the state of the market and the broader economy. While some buyers may find relief in slightly lower mortgage rates, the underlying economic uncertainty is keeping many potential homeowners on the sidelines.

Despite a 2.2% decrease in sales year-over-year, there is a glimmer of hope for the past year, with total sales reaching 324,475, a 2% increase from the previous year. However, this figure still falls 26% below the long-term average, highlighting the ongoing challenges in the California housing landscape.

Home prices continue to be a major hurdle for buyers. The median selling price for homes in California stood at $735,125 in October, a slight 0.5% decline from last year, yet just 2% below the peak of $750,000 recorded in May 2024. Many homebuyers are deterred by these high prices, which have increased 9% over the past three years following a monumental 35% rise during the pandemic.

The Federal Reserve’s interest rate decisions have significantly impacted the market. After raising rates to combat inflation at its highest in four decades, the Fed began lowering rates in 2025 to stimulate the economy. As of October, mortgage rates averaged 6.4%, holding steady compared to last year, but down from a peak of 7.4% in November 2023.

The financial burden for buyers remains heavy. The typical California buyer is now facing an estimated monthly mortgage payment of $4,597, which is unchanged from last year but has surged 101% over the past six years. Furthermore, securing a home requires a daunting $147,025 for a 20% down payment, making homeownership increasingly challenging.

With these factors at play, many are left wondering: who can afford to buy in California today? Experts predict that until prices stabilize and economic uncertainty diminishes, the sluggish sales pace is likely to continue.

Jonathan Lansner, a business columnist for the Southern California News Group, emphasizes the urgency of the situation, suggesting that potential buyers may need to rethink their strategies. As the market evolves, all eyes will be on what happens next in California’s real estate landscape.

Stay tuned for updates as this story develops.